Amazon.com : YI Dual-Lens Indoor Camera, Home Security Camera System with Fixed Lens and Dome Camera in 1, Expanded Viewing Angle, Motion Tracking, Dual-Screen Display, Two-Way Audio, Phone Alerts : Electronics

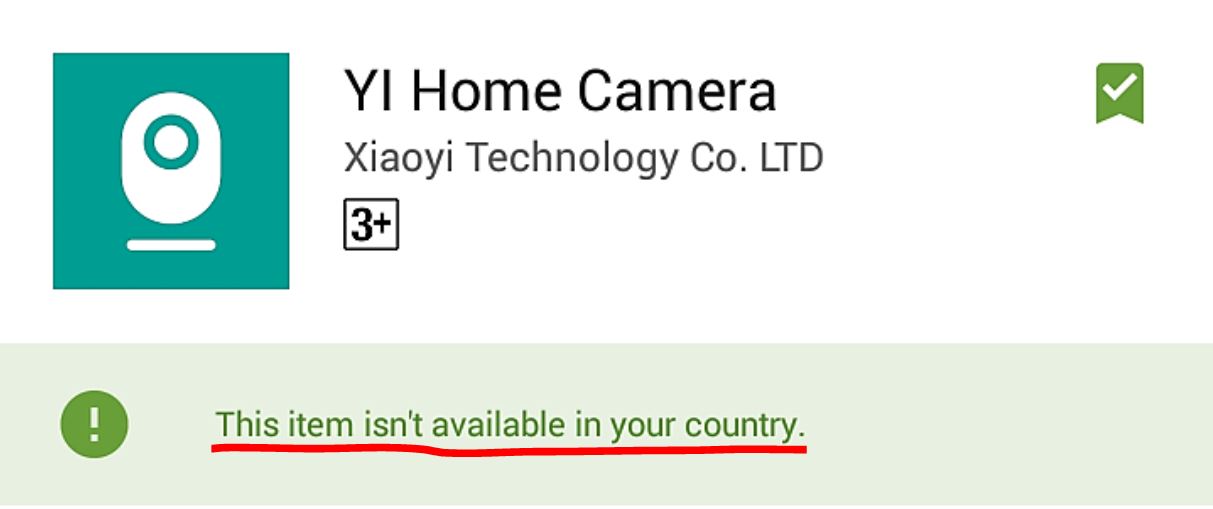

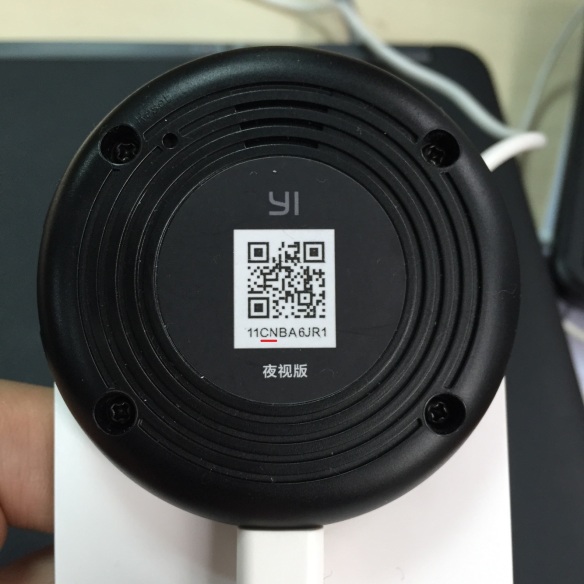

Fix XiaoYi "This camera can only be used within China"| ENG subរបៀបជួសជុលបញ្ហារបស់កាំមេរ៉ាXiaoYi - YouTube